الإسلام al-ʿIslām transl. Definition under Companies Act 2013 and its scope.

Inceif Islamic Financial Services Act Ifsa And Financial Services Act Fsa

Business of financial holding company 115.

. Malaysias first eBerkat marketplace a one-stop virtual financial services. 11th July 2013 reported as PTCL 2014 BS. Personal Data Protection Act 2010.

Power to issue directions to financial holding company and subsidiaries 117. Absa Islamic banking has not only developed Shariah-compliant products but it has adopted an end-to-end Shariah process. Section 2 substituted by the Sindh Finance Act 2013 XLI of 2013 Assented on.

Due to the scheduled platform change for ISRA International Journal of Islamic Finance IJIF in. Interpretation In this Act unless the context otherwise requires accreditation means the procedure by which the accreditation agency formally recognizes the status of an institution offering basic education and confirms in writing by way of a documentation issued under this Act. We conduct a meta-analysis of the relationship of financial literacy and of financial education to financial behaviors in 168 papers covering 201 prior studies.

New Date for filing of Returns under Lokapal and Lokayuktas Act2013. Islamic banking Islamic finance Arabic. The Committee on Foreign Investment in the United States CFIUS Exchange Stabilization Fund.

Peer-reviewed refereed journal aiming at engaging academicians as well as practitioners. مصرفية إسلامية or Sharia-compliant finance is banking or financing activity that complies with Sharia Islamic law and its practical application through the development of Islamic economicsSome of the modes of Islamic bankingfinance include Mudarabah profit-sharing and loss-bearing Wadiah safekeeping Musharaka joint venture. Definitions--In this Act unless there is anything repugnant 1.

Cancellation of FCRA registration of the associations for not filing mandatory Annual Returns for the Financial Year 2017-18 No963913JSF2017. Focus on the areas of Islamic economics finance banking capital markets takaful and law. It is the worlds second-largest religion with more.

Services Under FCRA. Prudential requirements on financial holding company and subsidiaries 116. Innovations in Financial Services.

Shadow Banking System. At the time of substitution Rule 2 was as under-- 2. Treasury International Capital Data for June.

This Act may be cited as the Basic Education Act 2013. In accordance with the new Act the companies involved in transaction pertaining to consultancy services financial services e-commerce etc. Issue 4 2013 Papers from the International Islamic Finance Conference Abu Dhabi April 15-16 2013 and the International Islamic Accounting and Finance Conference IIAFC 2012 Malaysia November 20 -21 2012.

Islamic Financial Services Act 2013 An Act to provide for the regulation and supervision of Islamic financial institutions payment systems and other relevant entities and the oversight of the Islamic money market and Islamic foreign exchange market to promote financial stability and compliance with Shariah and for related consequential or incidental matters. Minimum Due Diligence Guide on Foreign Exchange Rules. ADGMs Financial Services Regulatory Authority FSRA was established to advocate a progressive financial services environment by managing any potential risks exposure and undesirable impact.

Submission to God is an Abrahamic monotheistic religion centred primarily around the Quran a religious text that is considered by Muslims to be the direct word of the God of Abraham or Allah as it was revealed to Muhammad the main and final Islamic prophet. Having the customer base in India would be required to establish a permanent place of work in India through registration. Bank may approve more than one financial holding company 114.

All our products and detailed embedded processes are approved and certified by the Absa Islamic banking Shariah Supervisory Board comprising of eminent scholars in the field of Islamic banking. A shadow banking system refers to the financial intermediaries involved in facilitating the creation of credit across the global financial system but whose members are not. We find that interventions to improve financial literacy explain only 01 of the variance in financial behaviors studied with weaker effects in low-income samples.

Published in association with the International Shariah Research Academy for Islamic Finance ISRA. 3 This Act shall come into force with effect from the first day of July 2011. Approval of application as financial holding company under section 110 or 111 113.

Islam ˈ ɪ s l ɑː m. Filing of returns under Lokpal and Lokayuktas Act 2013. Sunday November 29th 2020.

Treasury Releases Initial Information on Electric Vehicle Tax Credit Under Newly Enacted Inflation Reduction Act. Islamic Financial Service Act 2013.

Inceif Islamic Financial Services Act Ifsa And Financial Services Act Fsa

Journal Of International Banking Financial Law Lexisnexisjibfl Twitter

Competition Capital Growth And Risk Taking In Emerging Markets Policy Implications For Banking Sector Stability During Covid 19 Pandemic Plos One

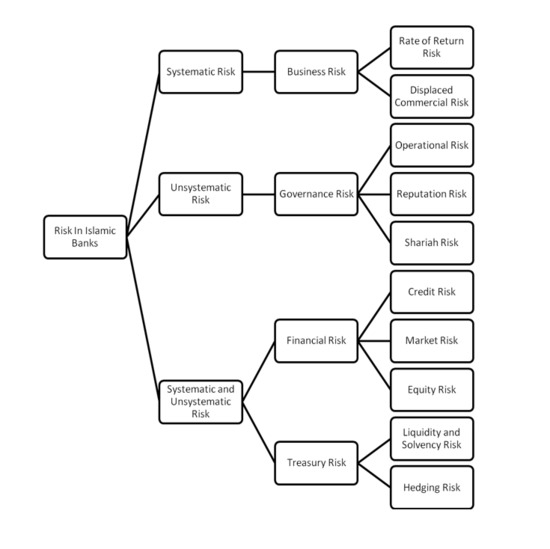

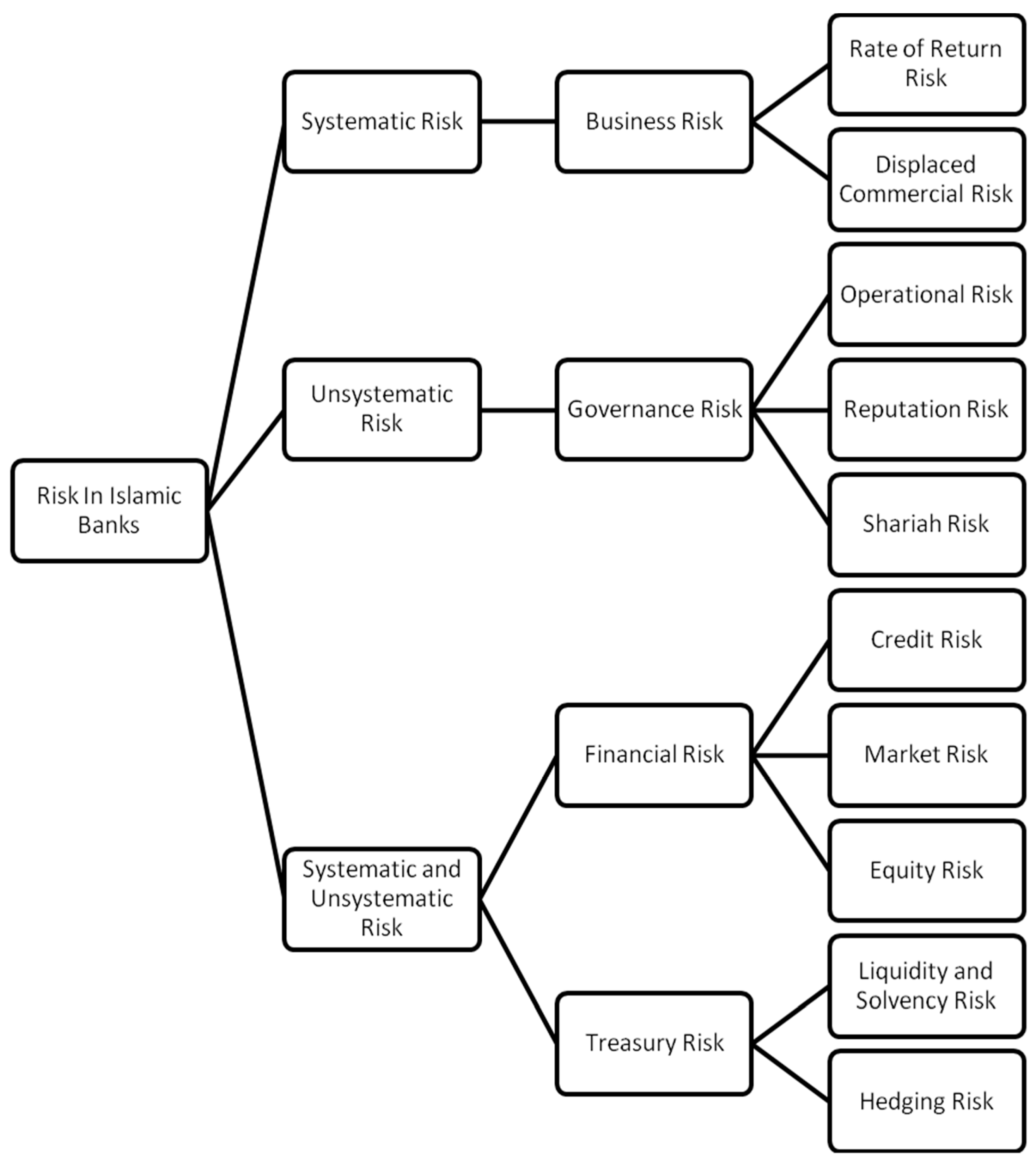

Jrfm Free Full Text Developments In Risk Management In Islamic Finance A Review Html

Inceif Islamic Financial Services Act Ifsa And Financial Services Act Fsa

Malaysia Islamic Finance And Financial Inclusion

Economic Growth And Financial Performance Of Islamic Banks A Camels Approach Emerald Insight

Calculation Of Financial Intermediation Services Indirectly Measured Fisim For Islamic Banking Activity In Malaysia Ios Press

Islamic Finance An Overview Sciencedirect Topics

Inceif Islamic Financial Services Act Ifsa And Financial Services Act Fsa

Jrfm Free Full Text Developments In Risk Management In Islamic Finance A Review Html